The goal

Enabling Credit Suisse clients to move into UBS with a seamless, low-friction digital journey.

1.2M

migrated clients

2 years

of collaborative work

4,1/5

satisfaction score

My key role

As a Senior UX Designer, I crafted and tested interface solutions at Credit Suisse to guarantee a smooth, trusted client migration.

Built from constraints

There was no playbook. No comparable banking merger of this scale existed and early on, UBS and Credit Suisse weren’t aligned. We had to design with limited information, different technical systems, and strict budgets: trusting our instincts, then validating every step through testing and iteration.

Built from constraints

There was no playbook. No comparable banking merger of this scale existed and early on, UBS and Credit Suisse weren’t aligned. We had to design with limited information, different technical systems, and strict budgets: trusting our instincts, then validating every step through testing and iteration.

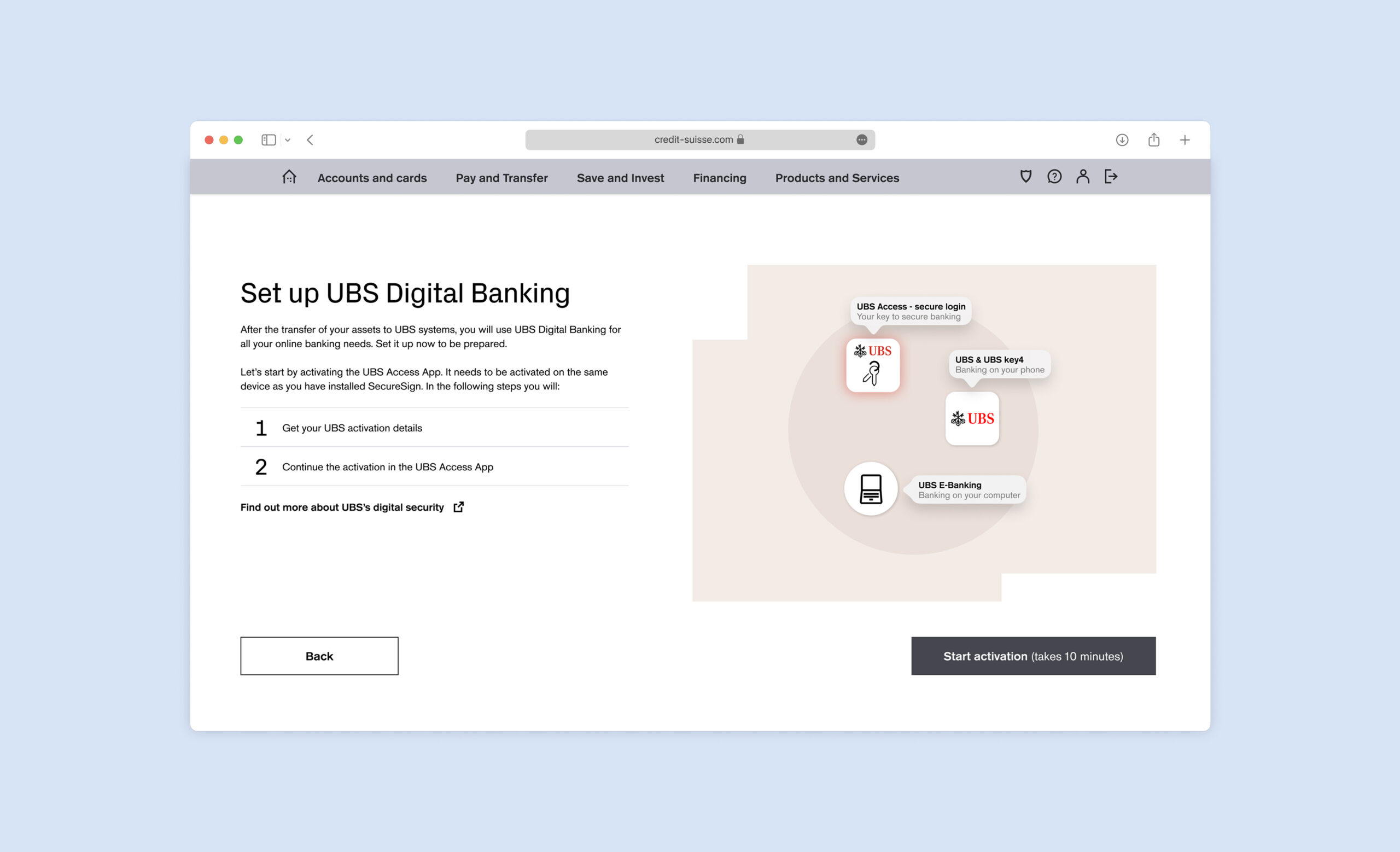

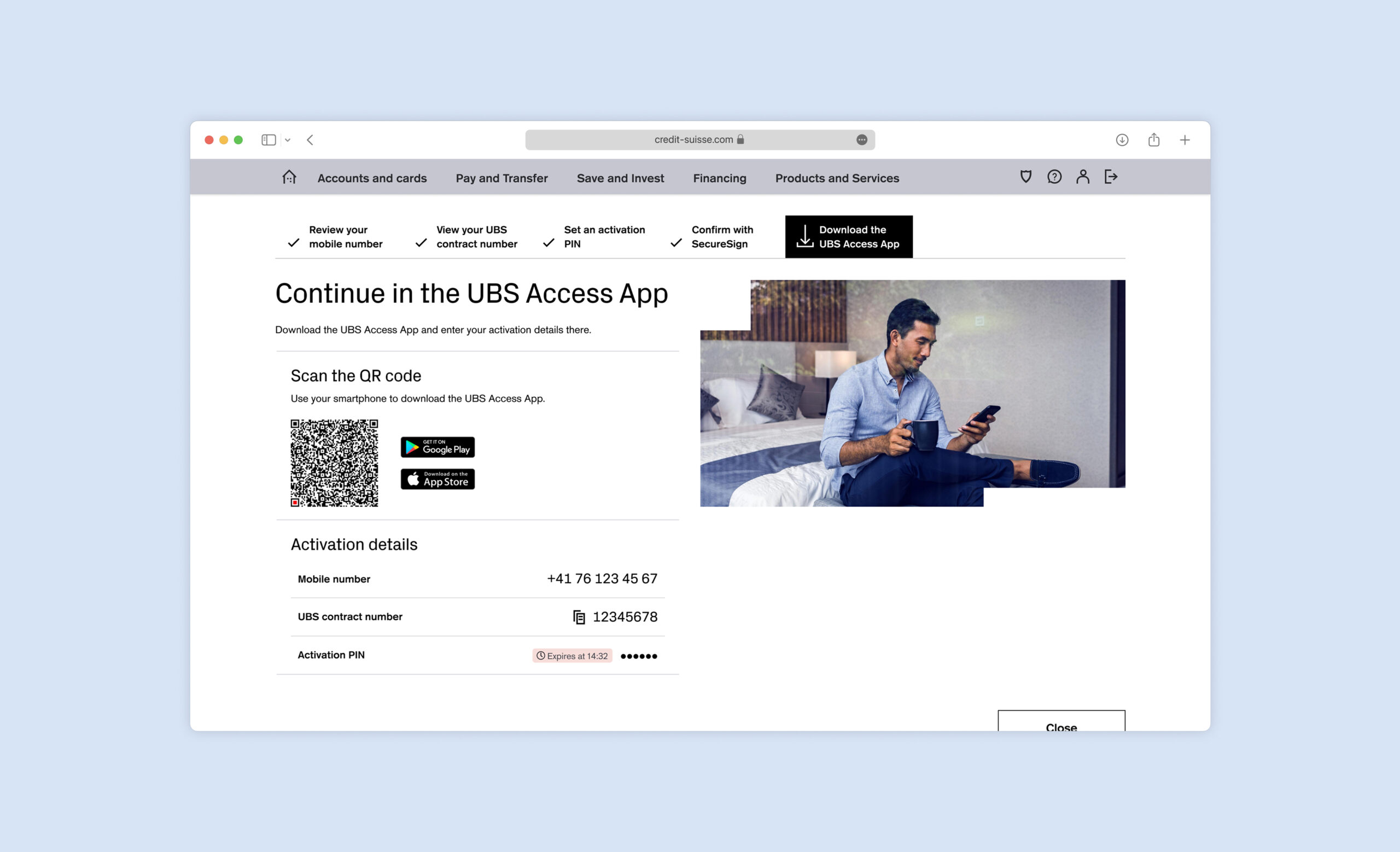

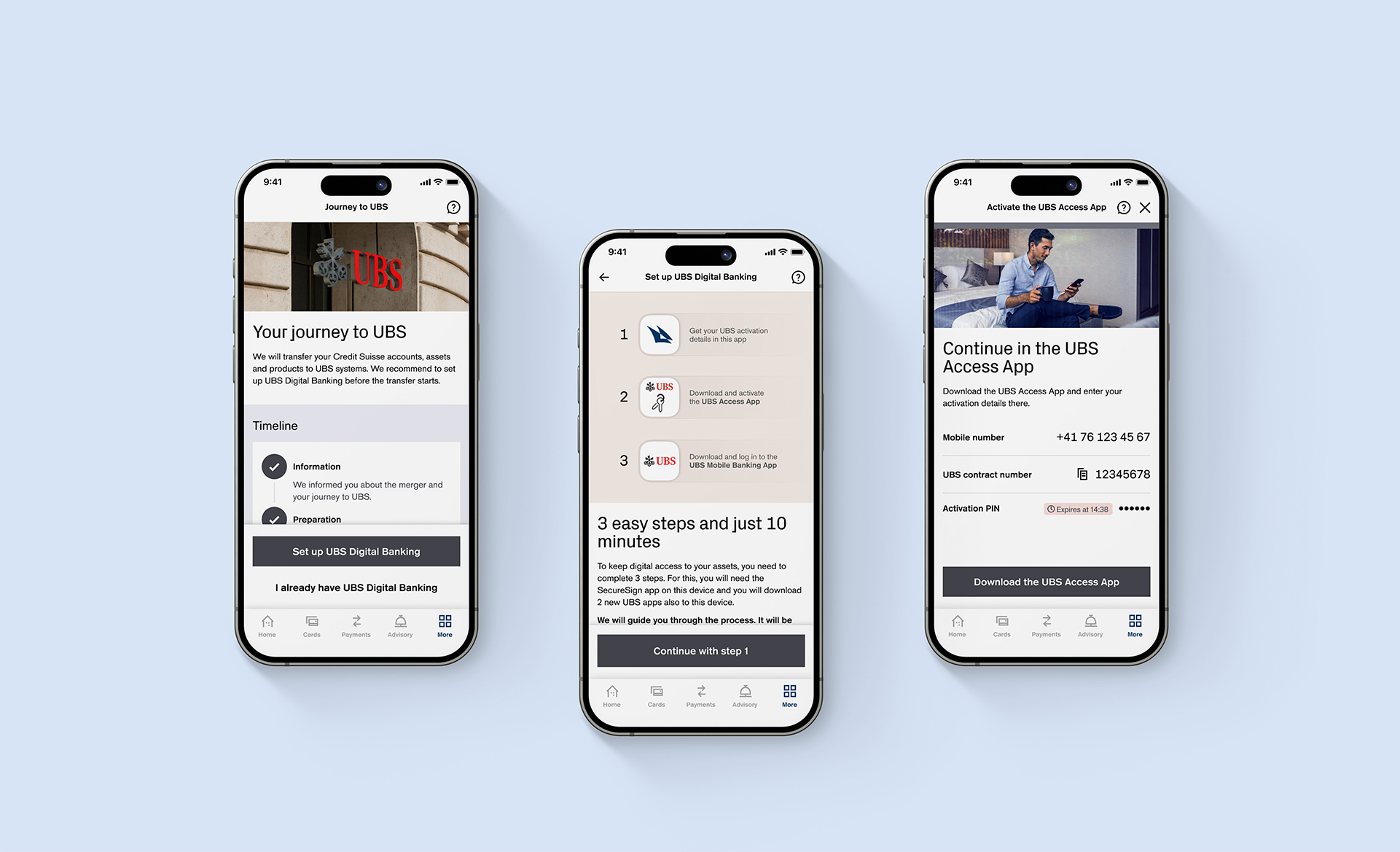

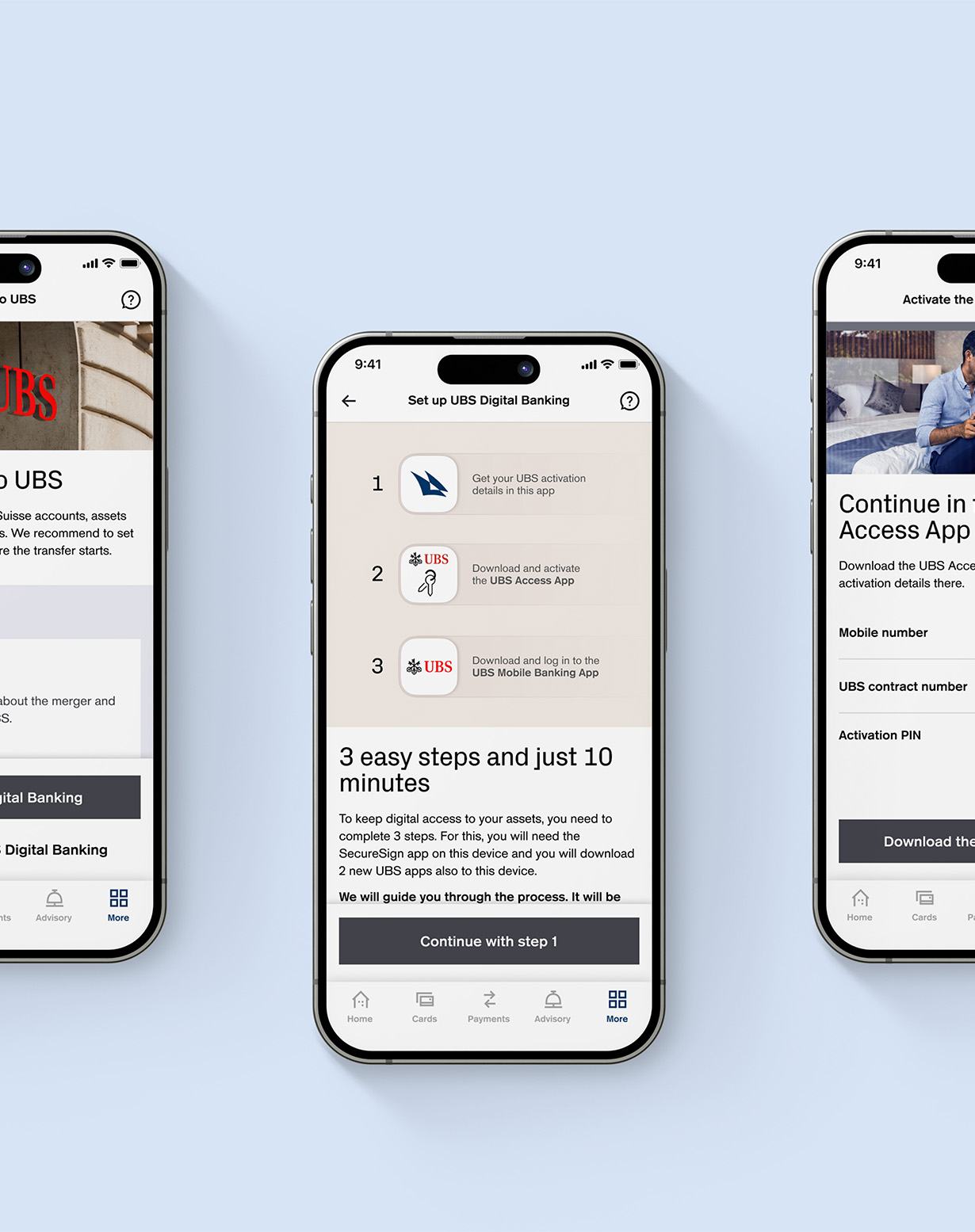

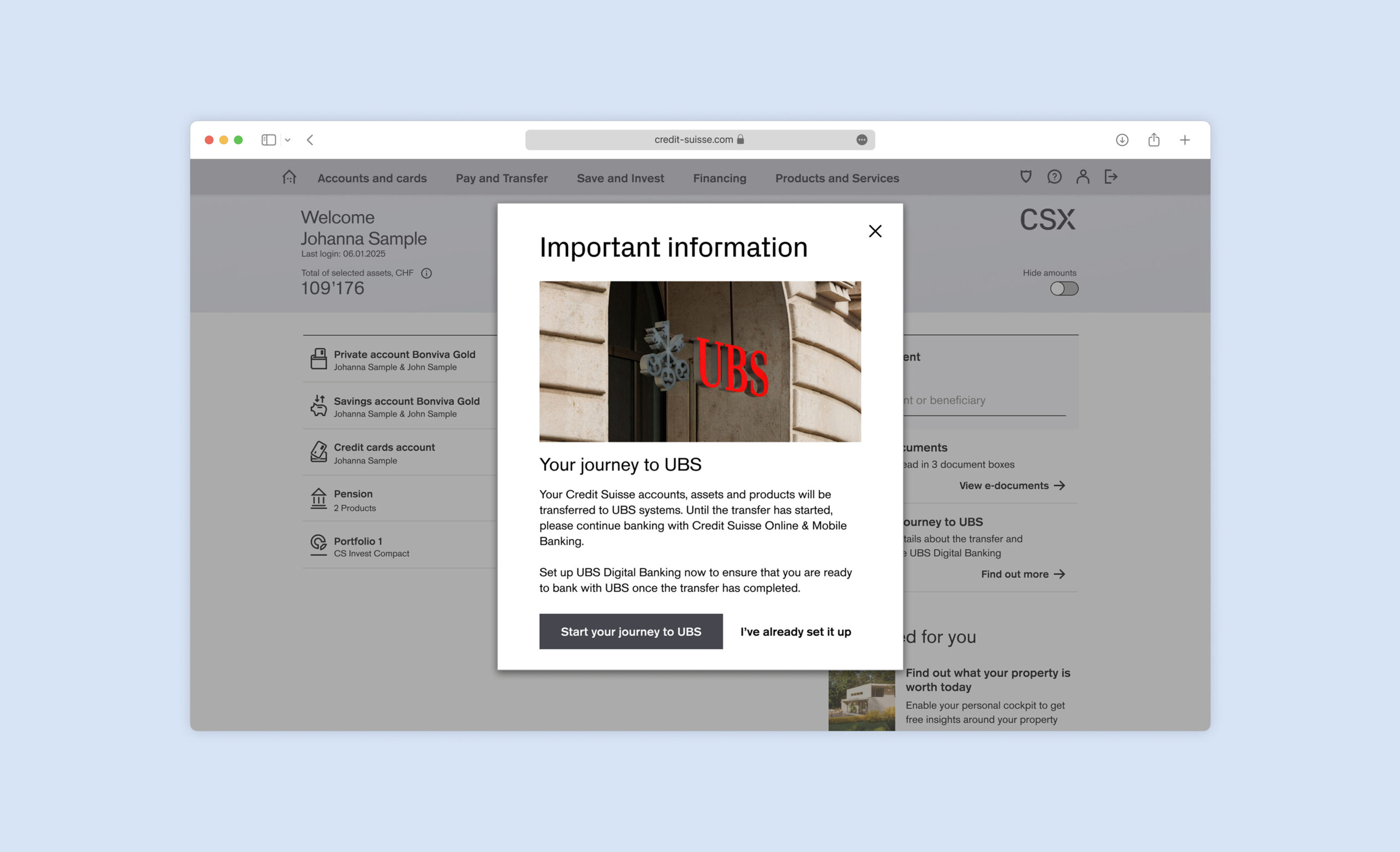

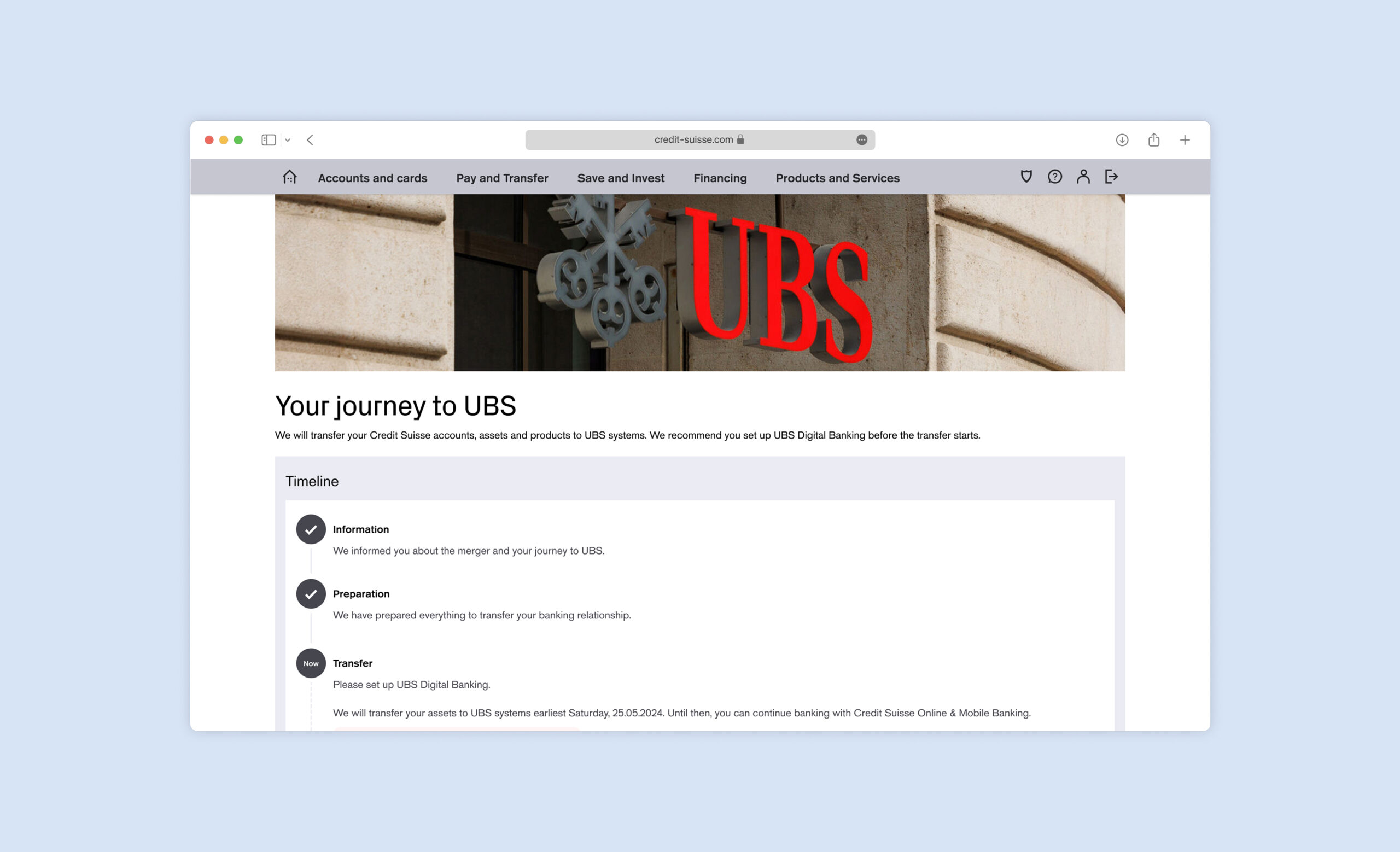

Imagine the best possible journey

We started by proposing concepts to imagine the best possible migration journey. These evolved into detailed prototypes that were tested with real users. Along the way, I collaborated daily with developers to make sure implementation matched the agreed designs, while keeping pace with shifting requirements.

Imagine the best possible journey

We started by proposing concepts to imagine the best possible migration journey. These evolved into detailed prototypes that were tested with real users. Along the way, I collaborated daily with developers to make sure implementation matched the agreed designs, while keeping pace with shifting requirements.

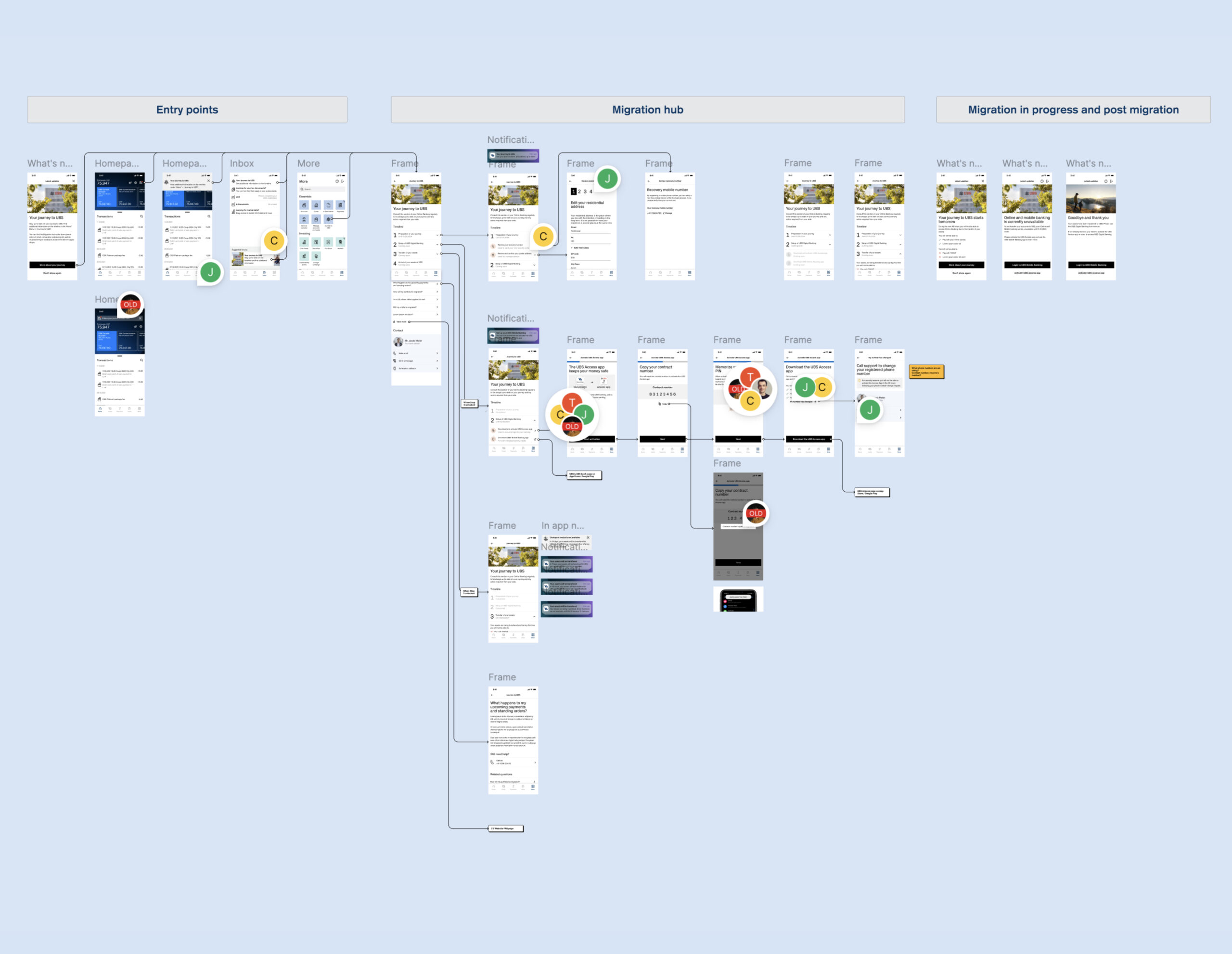

Turning pain points into flows

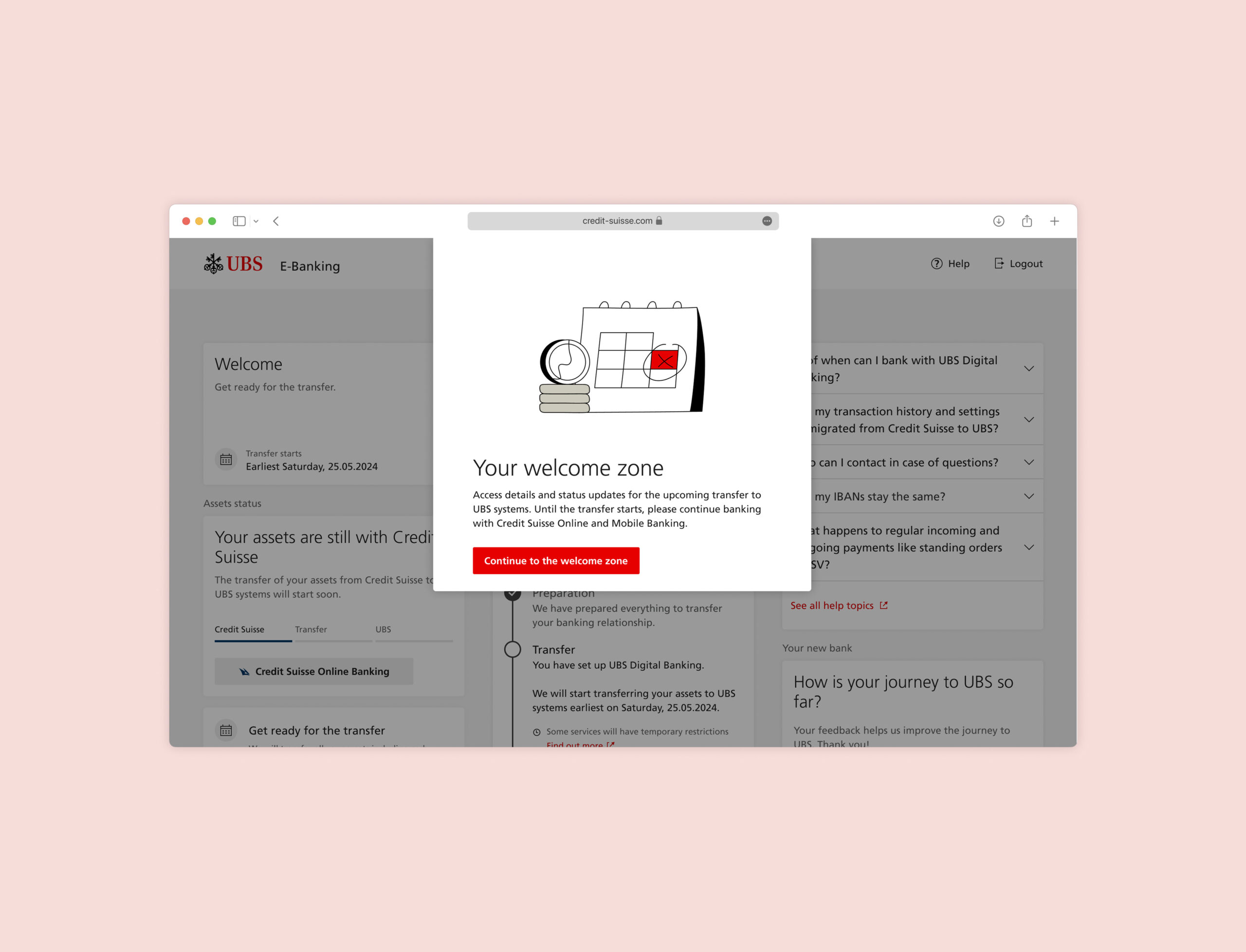

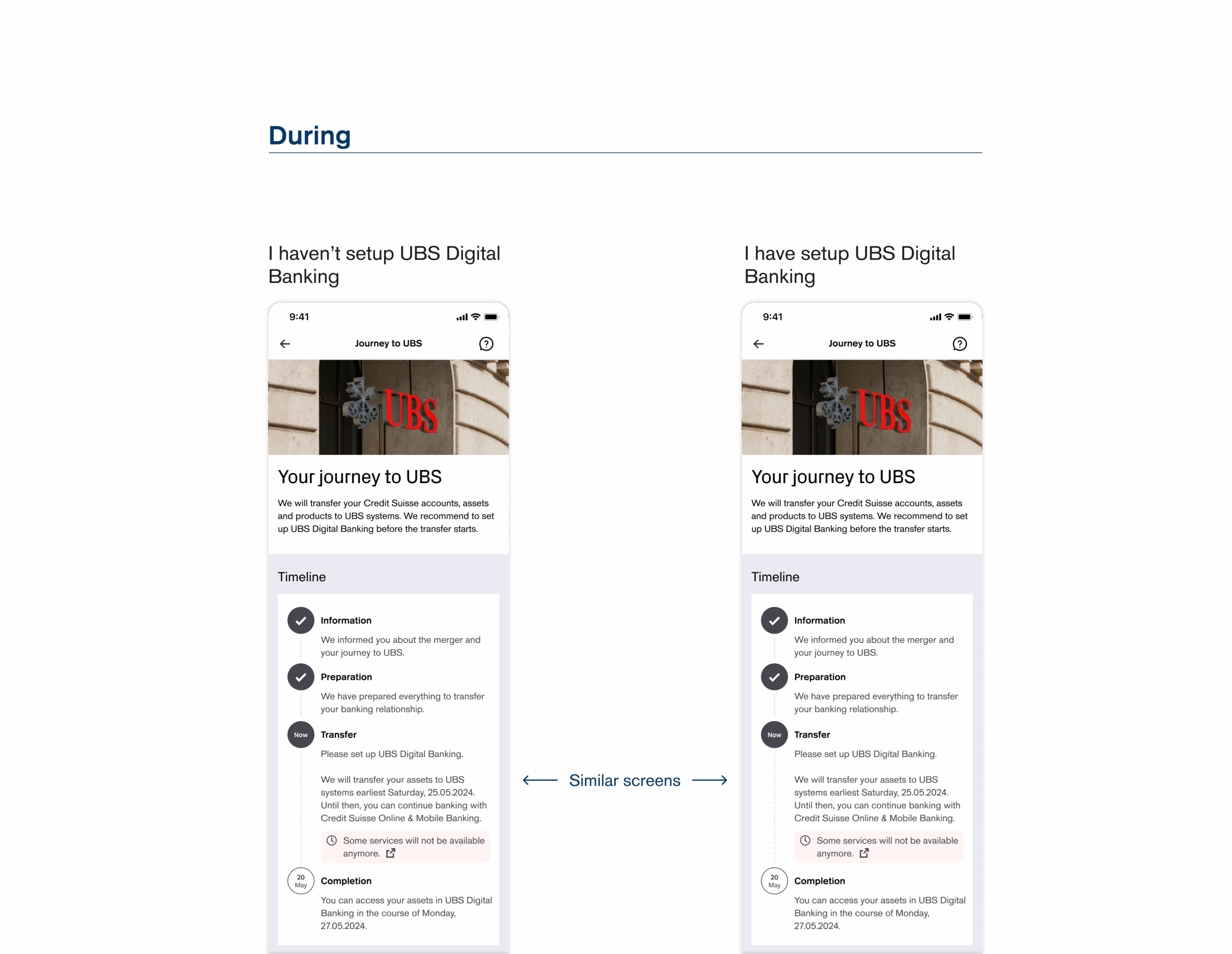

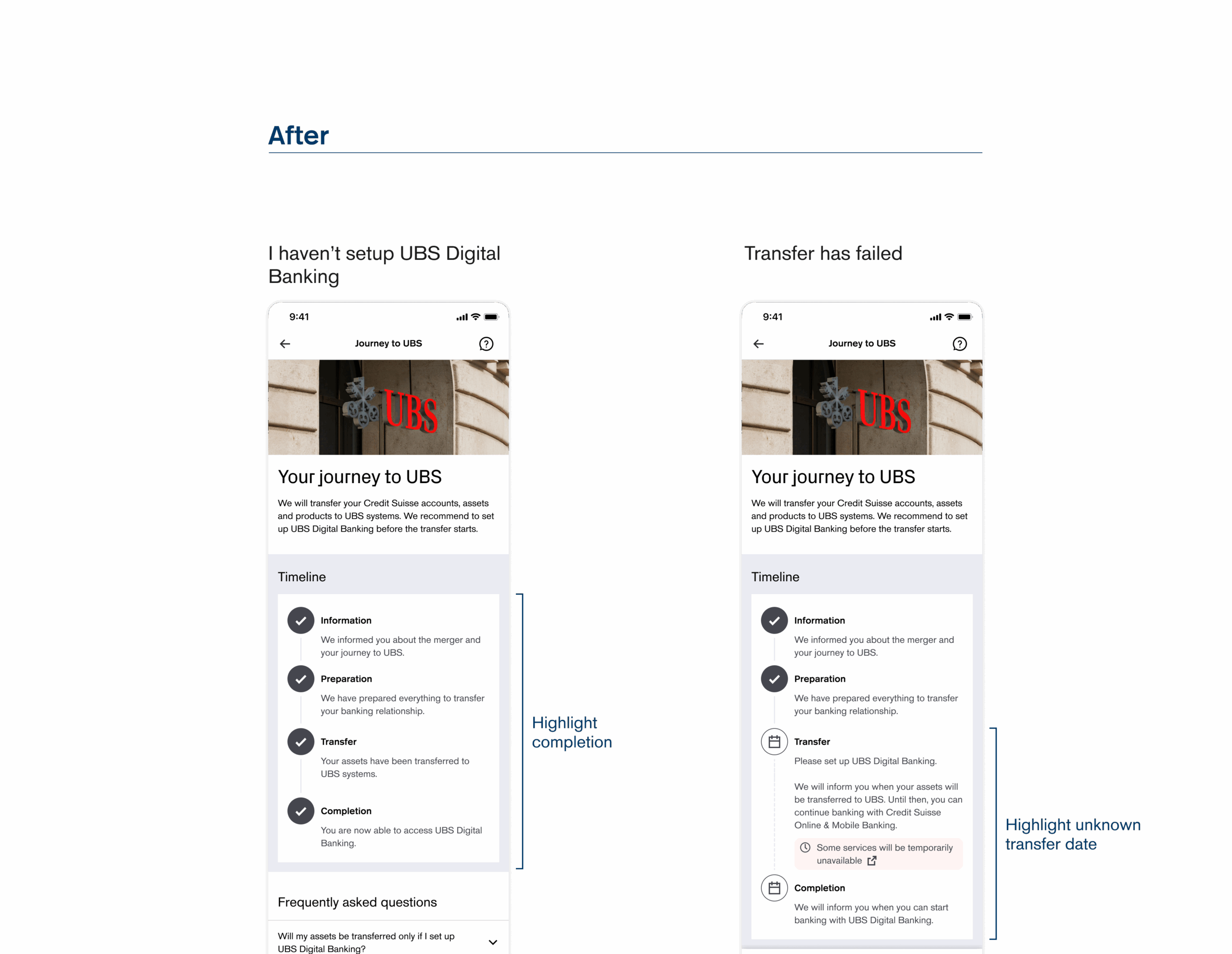

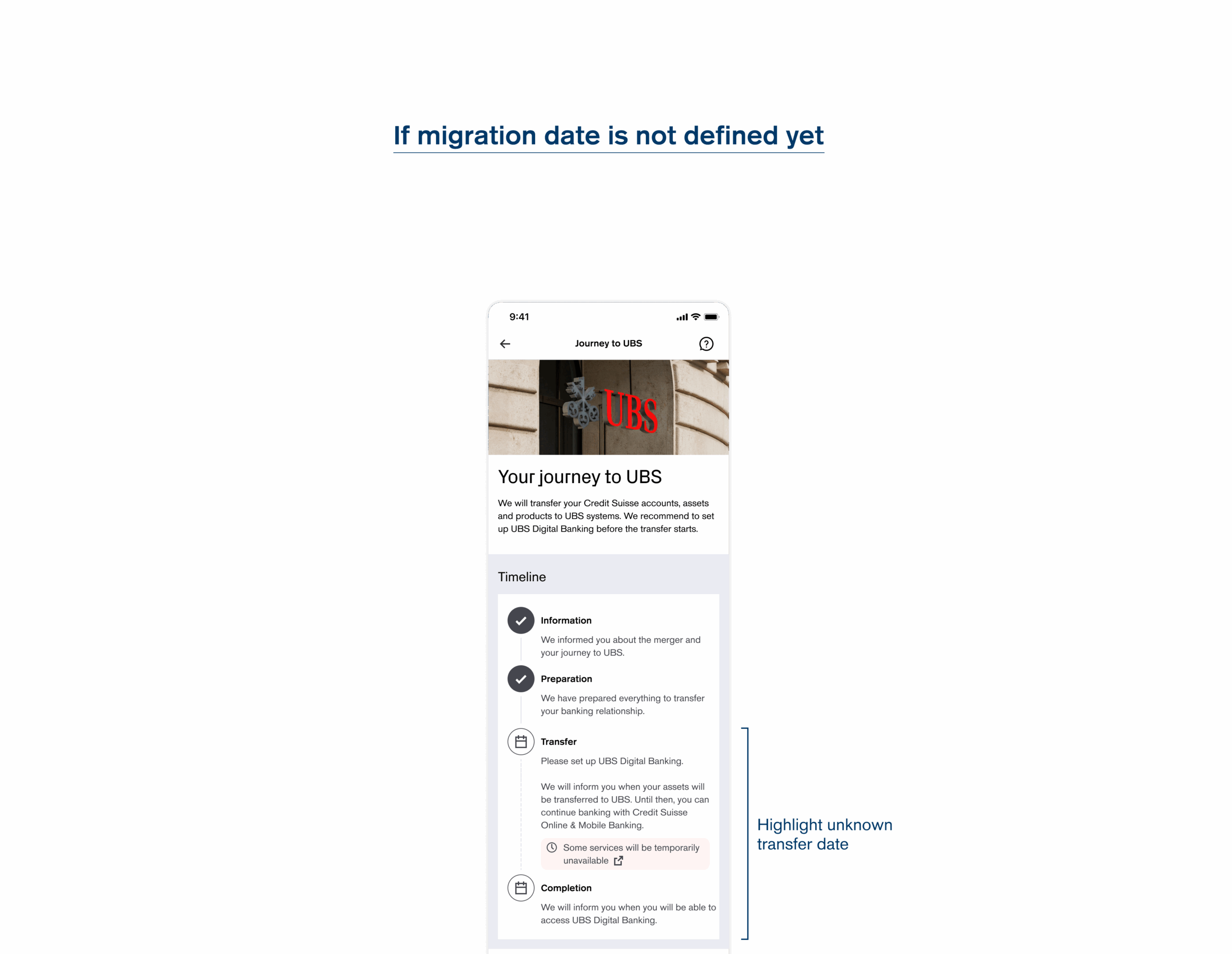

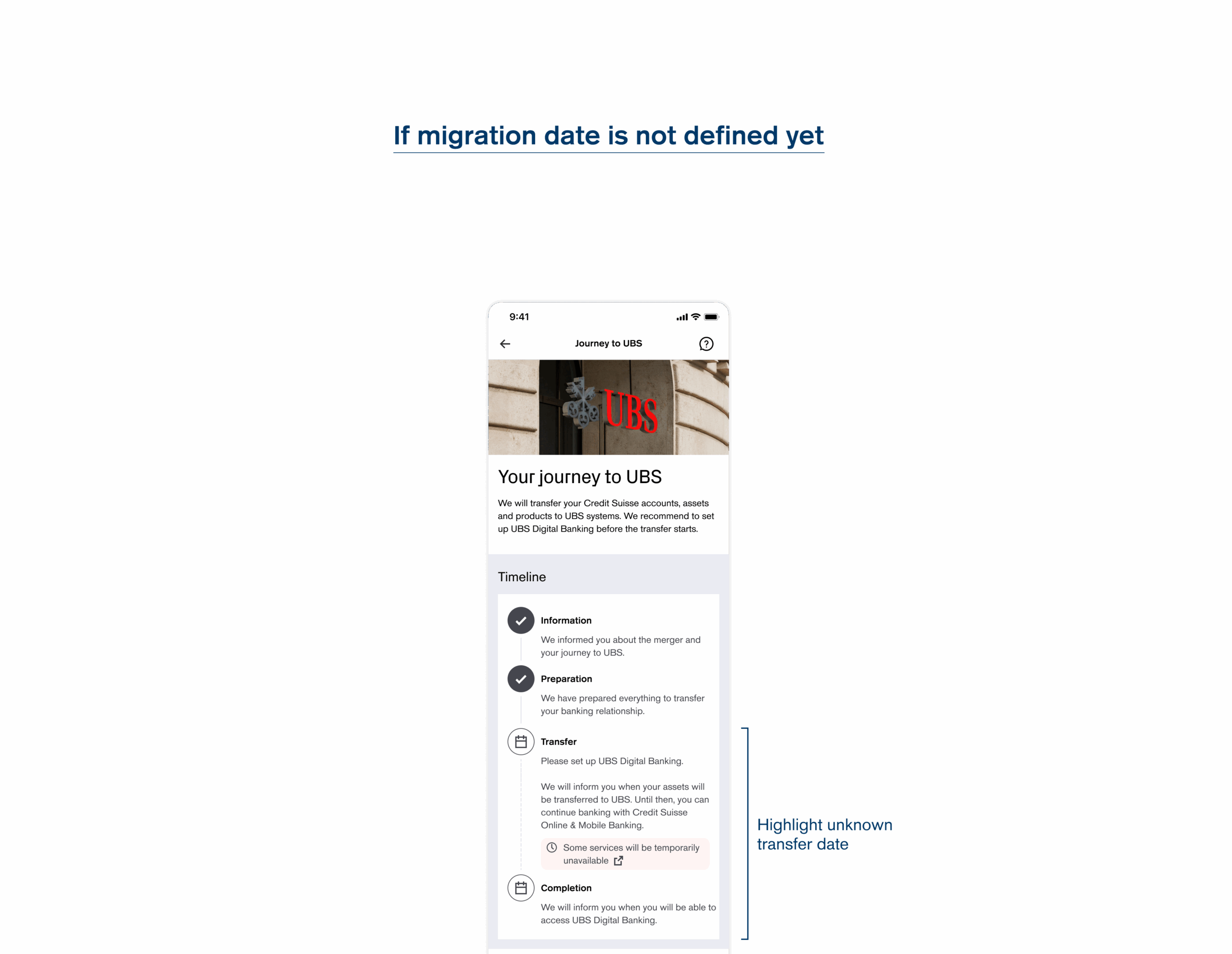

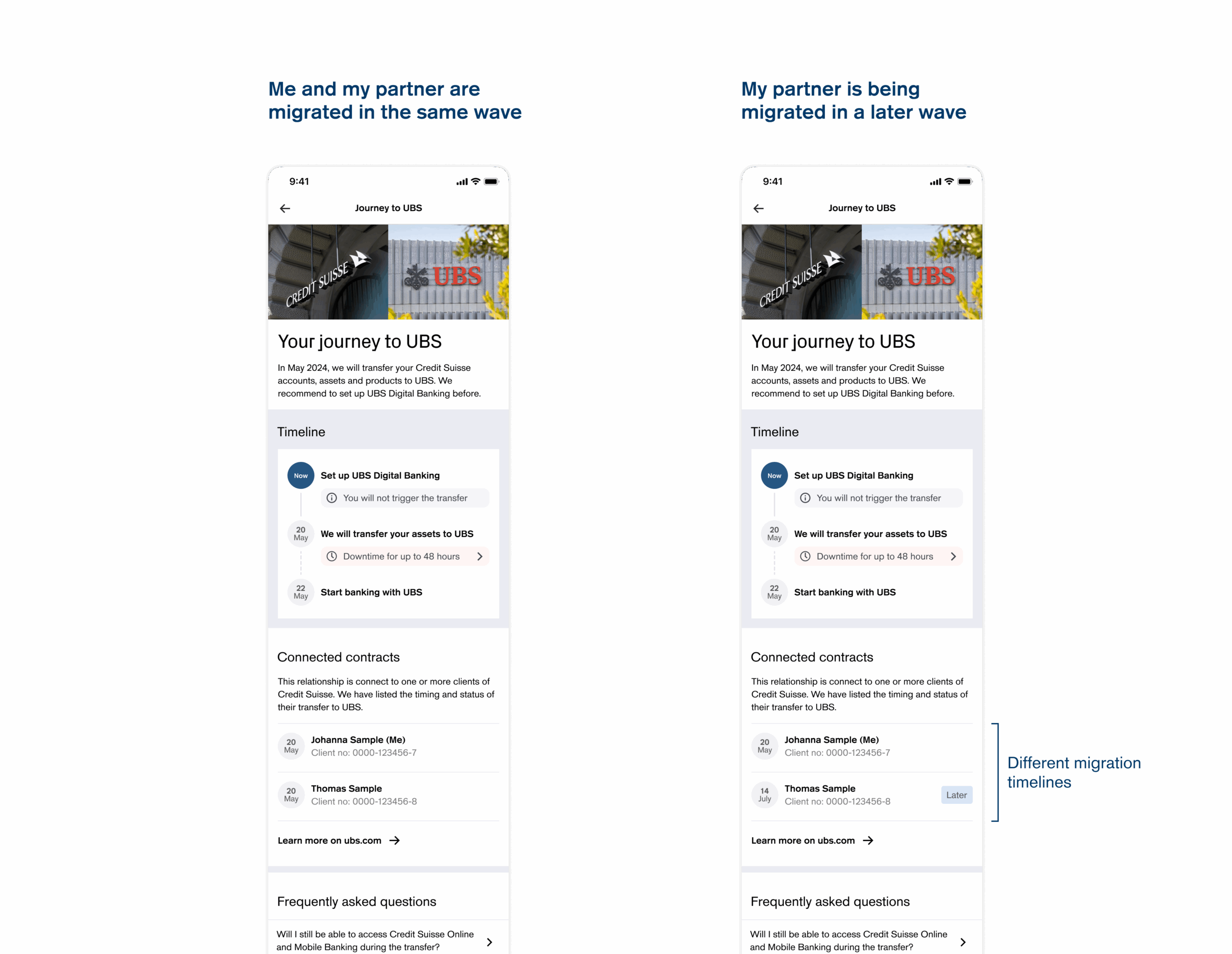

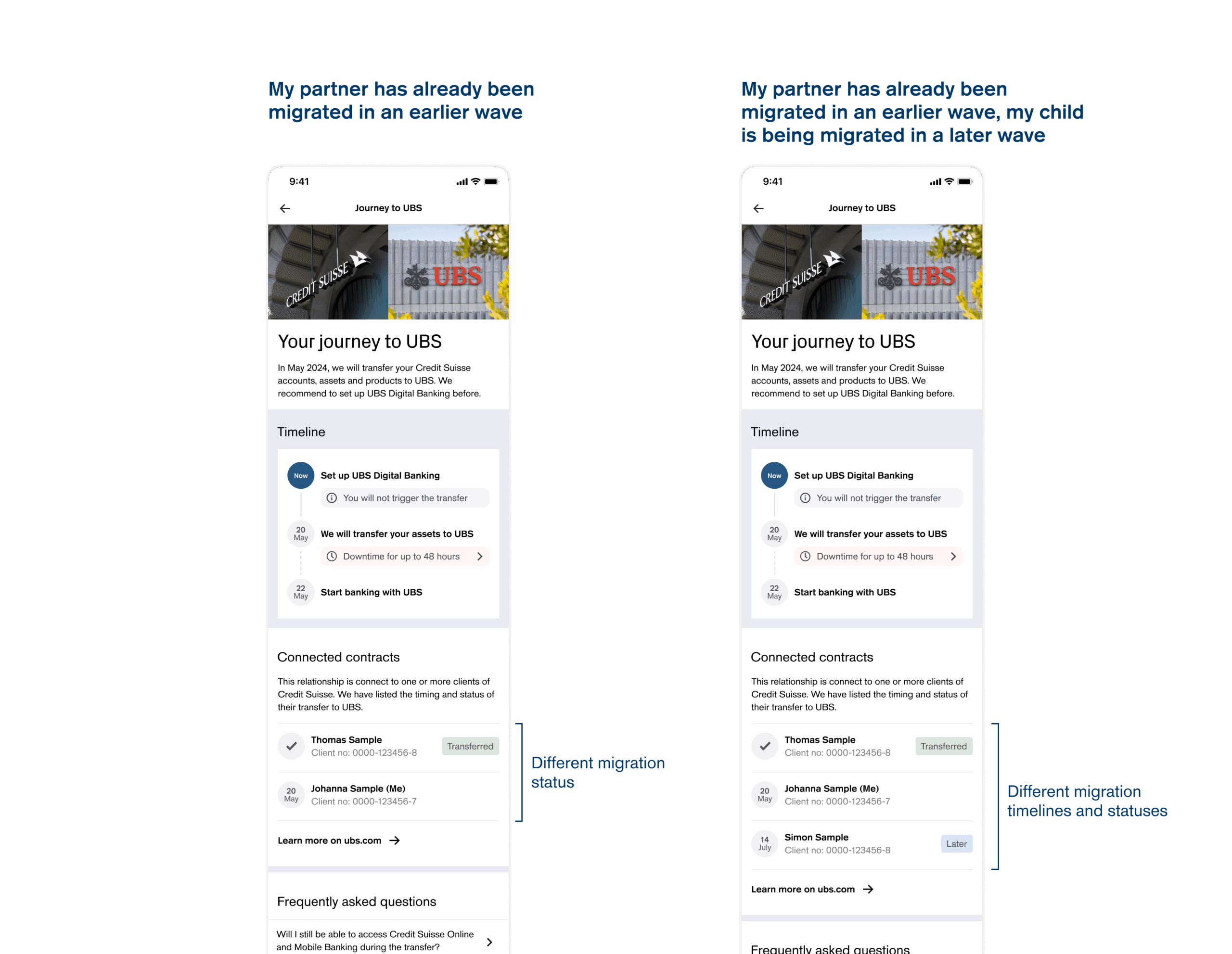

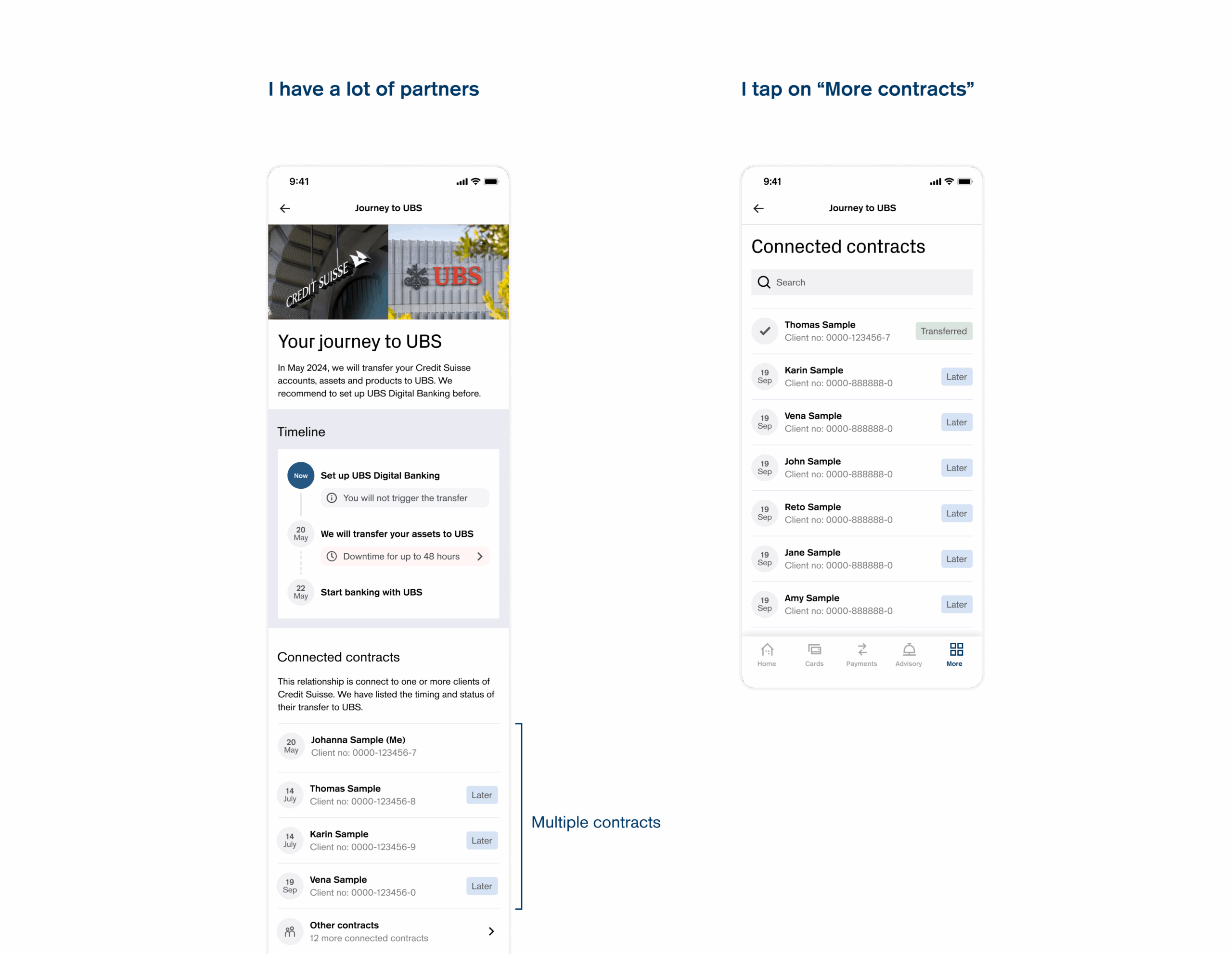

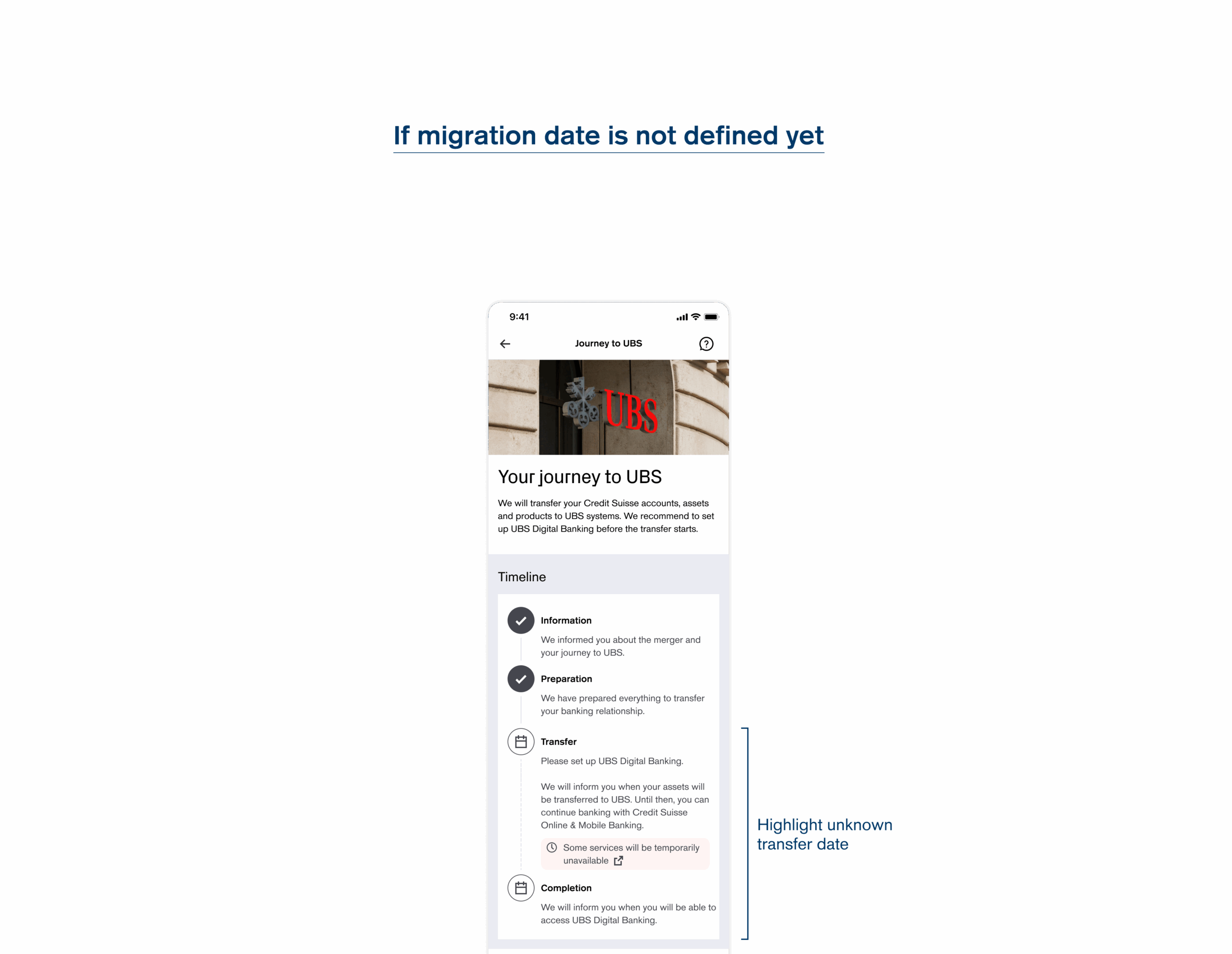

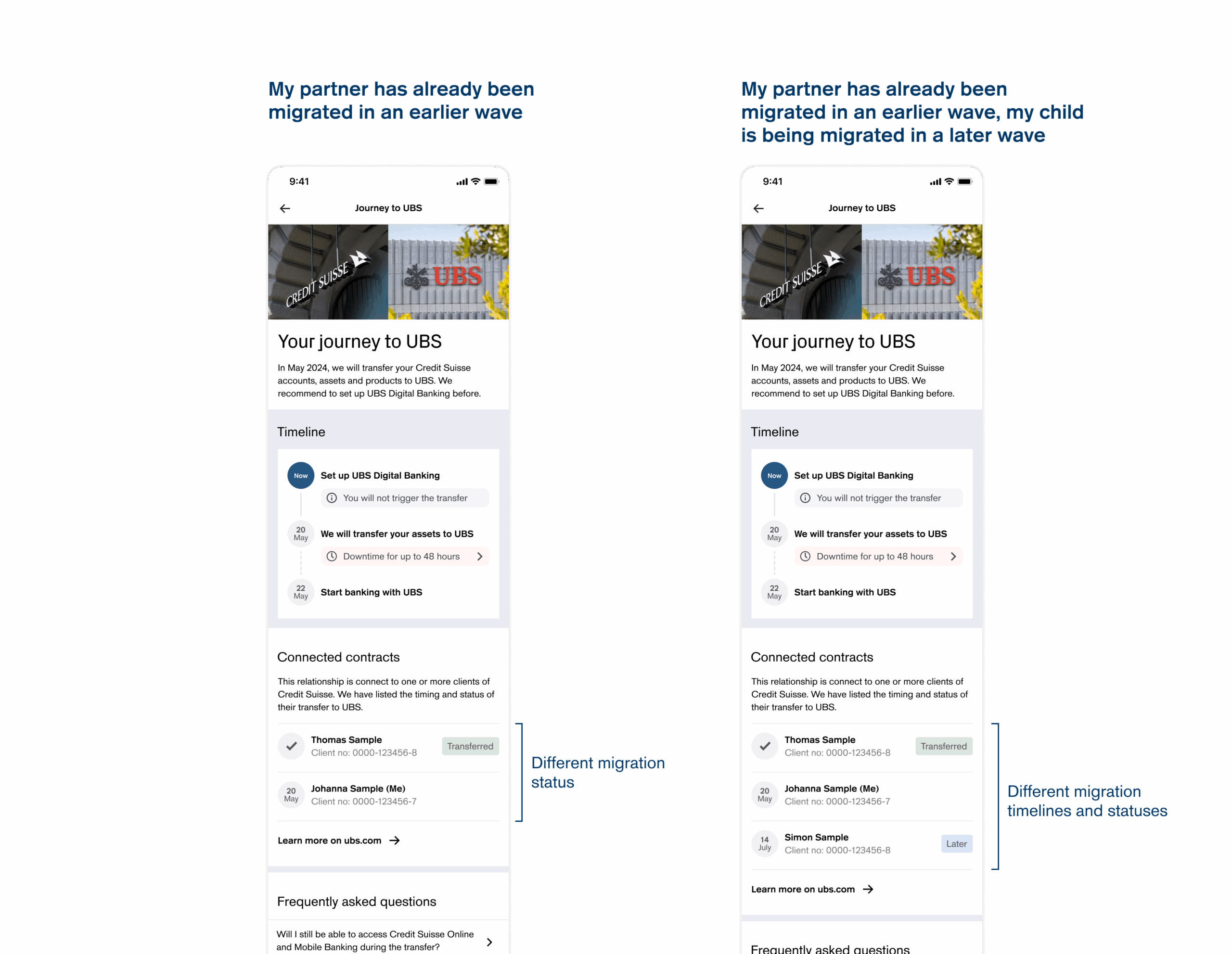

Migrating 1.2 million clients meant designing for scale where even a 1% failure equaled 12,000 blocked users. Beyond the main flow, countless edge cases had to be anticipated: joint accounts, missing recovery numbers, legacy login methods, and multi-wave migrations leaving customers in different states at the same time.

The digital journey also had to stay consistent with offline touchpoints like letters, hotlines, and advisors, all while ensuring that critical services like payments remained accessible during migration weekends.

Turning pain points into flows

Migrating 1.2 million clients meant designing for scale where even a 1% failure equaled 12,000 blocked users. Beyond the main flow, countless edge cases had to be anticipated: joint accounts, missing recovery numbers, legacy login methods, and multi-wave migrations leaving customers in different states at the same time.

The digital journey also had to stay consistent with offline touchpoints like letters, hotlines, and advisors, all while ensuring that critical services like payments remained accessible during migration weekends.

The who and the why

The clients ranged from everyday retail customers to wealth management clients and small businesses. Each had different needs and account setups: joint accounts, multiple contracts, or legacy login devices, making it essential to design flows that felt simple and reassuring for all, regardless of their banking relationship or technical literacy.

The who and the why

The clients ranged from everyday retail customers to wealth management clients and small businesses. Each had different needs and account setups: joint accounts, multiple contracts, or legacy login devices, making it essential to design flows that felt simple and reassuring for all, regardless of their banking relationship or technical literacy.

The team that made it happen

Dozens of stakeholders were involved: business, developers, copywriters, researchers, client advisors... Spread across two rival banks suddenly forced to merge. With constant turnover and reassignment, clear communication and alignment were critical. My role was not just to design, but to bring people together around a consistent user experience.

Core outcomes

A unified journey for different platforms in one seamless flow.

The migration proved that even in high-stakes, fast-moving contexts, early prototyping and testing can uncover gaps no one anticipated. Close collaboration with developers during implementation was key to keeping flows consistent, despite shifting requirements.

Key learnings

I learned that designing at scale means treating edge cases as central, since even 1% represents thousands of users. Alignment became a continuous design activity, with shifting stakeholders and constraints forcing me to document and communicate clearly.

Above all, I realized that UX in this context went beyond functionality: it was about building trust through reassurance, transparency, and continuity.

Zürich, CH